Have you ever wondered if there are some hidden techniques that the ultra-wealthy use to create and steward wealth generation after generation? Why is it that the “Top 1%” always seem to come out on top? Even during recessions, stock market crashes, and bursting real estate bubbles. There are probably a lot of reasons. But I have discovered one of them. And I’m going to share it with you today.

It’s really a simple answer. In fact, this discovery is as simple as it gets. Yet sadly, most folks will never see it or hear about it. You will.

Ask yourself this. Are you the kind of strong-minded person, who once seeing the facts, can then buck the “common wisdom” of the masses and move ahead with something that makes sense? If so, read on.

So, what is this discovery to supercharge the creation and protectively sustaining long-lasting wealth? It is simply a change of mindset. But remember, simple is not always easy. Because of this, only a small percentage of perceptive people will act on it. Will you be one of them?

Few folks are willing to open their minds to a new way of thinking. That’s bad news for them. And it’s good news for enlightened individuals who are willing to think outside the box. I bet you are one of them. You’re still reading.

For example, owning timber requires a special mindset. It requires us to consider a long cycle cash flow model. Few average folks can or will consider this. But the ultra-wealthy do. So do large institutions and Ivy League schools. In fact, they especially like the long cycle because so many (most) average investors avoid it. Scarcity creates an even higher return.

A favorite quote of mine sums this up very well. There’s no competition outside the masses. Strive to be outside the competition. The investment elite understands this very well. Do you?

Recently I was asked to participate in a very high-end conference in Belize for accredited investors and family office representatives. Joel Nagel is the organizer of PW23 “Winter is Coming.” It’s his 23rd annual Presidents Week and he asked me specifically to come up with a topic that would fit this crowd of high net worth players. So, I did.

The presentation I prepared features many examples of heavy hitters over the past few centuries who have been able to see powerful, long-term trends and take advantage of multi-century track records. Yes, 300-year track records. These elites know the value in stewarding wealth long term and wisely tap into opportunities that lie “outside the competition.”

What is the secret that these one-percenters know? Simply the recognition that time is our friend. And long cycles for investment return are our best friend, especially if we care about stewarding wealth for our families and generations to come. These top family offices, institutions and endowments simply act upon information that the average individual does not.

But again, simple isn’t always easy. Sadly, most people only focus on the here and now. If you are one of them, just stop reading. The rest of this article will be a waste of your “here and now” time.

But if you are the kind of individual who knows that preparation for the future is prudent, wise and critically important, read on. You’ll see that a small course correction now in how you think about cash flow, can make a huge difference in the future.

Modern consumerism has lulled most folks into thinking about only the right now. Instant gratification. Money today. But note, cash flow generally has 3 periods. Sadly, the average individual only sees one of them, or at best perhaps 2 types of cash flow cycle.

Type one is easy. It’s the day to day cash flow we earn at our jobs. It’s salaries, consulting fees, or the rents we collect from rental properties on a monthly basis.

Mid-term cash flow is usually mistakenly referred to as “long term cash flow. Possibly to smokescreen the real long cycle cash flow, you’ll hear about in a minute. Mid-term cash flow is the investment we make in stocks and bonds, the annual dividends, or the capital gains we earn when we sell stocks or sell a property for a profit.

But here it is. The essence of powerful wealth creation and preservation. Drumroll, please.

Long cycle cash flow is the secret supercharger for long term wealth creation and preservation. The highest form of cash flow is long cycle cash flow.

You may ask yourself, “But why haven’t I heard about this before?” There are a few reasons, but they all really come from one foundation. Long cycle cash flow investments are hard to access on a scale that most people can afford.

Until now, the minimum investment sizes have been hundreds of thousands of dollars to tens of millions. For example, land banking. Buying huge tracts of land where an interstate highway interchange will be built in 10 – 15 years is popular. The returns are phenomenal, but it still requires big bucks to play in that arena.

Another area that the top 1% of the 1% play is in timber. This commodity is an excellent long-cycle cash flow investment. It matures and then is harvested over decades-long cycles. When harvested, it is replanted to begin the harvest cycle once again. Timber too has outsized returns, with IRR’s in the double digits compounding over decades. But it’s big money to have a seat at that table.

UNTIL NOW.

Timber, especially Teak timber, is an asset class that has all the excellent attributes of the long cycle cash flow. The good news is, given that I realized this supercharger secret 20 years ago and started my own 100-acre plantation in Panama back then, that this opportunity is now open to many more people, not just the ultra-rich. Plantation parcels start under $10,000.

Money is just one hurdle, though. The other is far more critical. It’s changing how we think about things. Simple, not easy.

Remember, most folks only see day to day cash-flow. Some folks recognize the importance of investing in stock, bonds, and rental properties. Only the very few can see the 3rd type of cash-flow. Only then can we begin to understand the power it presents.

The normal reaction to long cycle cash flow sounds like this. “25 years!!! Are you crazy? What if I need money now? I can’t wait for 25 years to get a return.” If this knee jerk reaction is yours, please stop reading. If, however, you are the kind of person who thinks outside the box, you may like what you are about to read.

Once our day to day cash flow needs are met, you’ll be able to see that long cycle cash flow does something else entirely. It creates, preserves, and enhances wealth at a whole different scale. A scale hard to imagine when thinking short term.

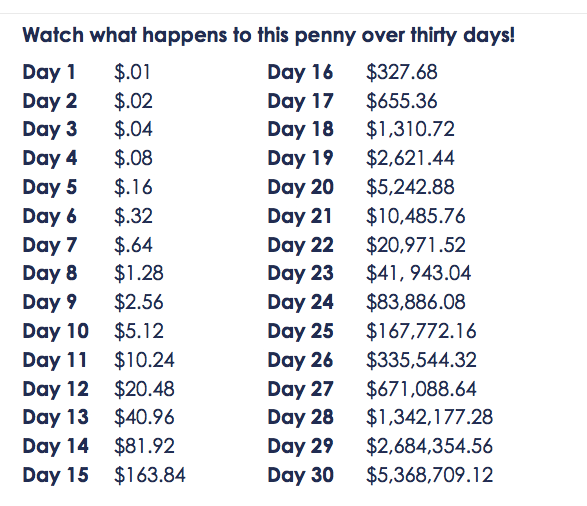

Compounding returns over 20+ years is powerful. Just look at this example below using a penny that doubles every day for 30 days.

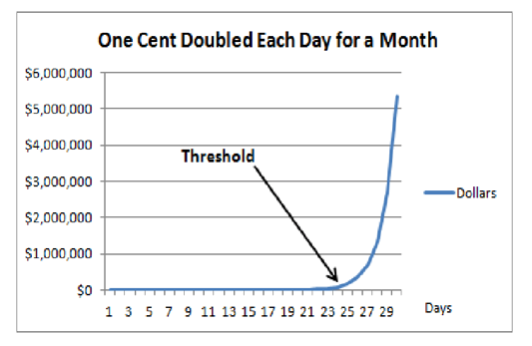

But look at the next chart to see very clearly why long cycle cash flow is so powerful. This is the part that most people miss. See the Super Charger Secret in graphic form:

Late Stage Explosion in Value

The difference between Day 26 and Day 30 is over $5M. Do you see the power of long cycle cash flow and the compounding effects long cycle? Can you see the Super Charger Secret now?

For the young investor, a 25-year timber cycle could produce a harvest return two, maybe three times in a lifetime. Then after the last harvest you receive, your kids, grandkids, and their grandkids get harvests for generations.

Timber is a reoccurring cash flow investment. It just happens to be on a long-cycle, 25-year basis. Long-cycle is cash flow. It’s the powerful kind.

Generational wealth stewardship has always been a trait of the ultra-wealthy. That’s why families like the Rockefellers, Vanderbilts, Bronfmans, and Kennedys, among many others, look for long cycle cash flow investments. They know how important it is to create, maintain, and steward wealth into the future. They expect future generations to stand on the shoulders they built by prudent, wise and far-sighted decisions today.

Teak Timber specifically has strong attributes that make it an excellent long-cycle cash flow investment. The 3 primary reasons are: 1) It is market neutral. 2) Prices have risen significantly for years. 3) Timber and the pricing data have long, successful track records.

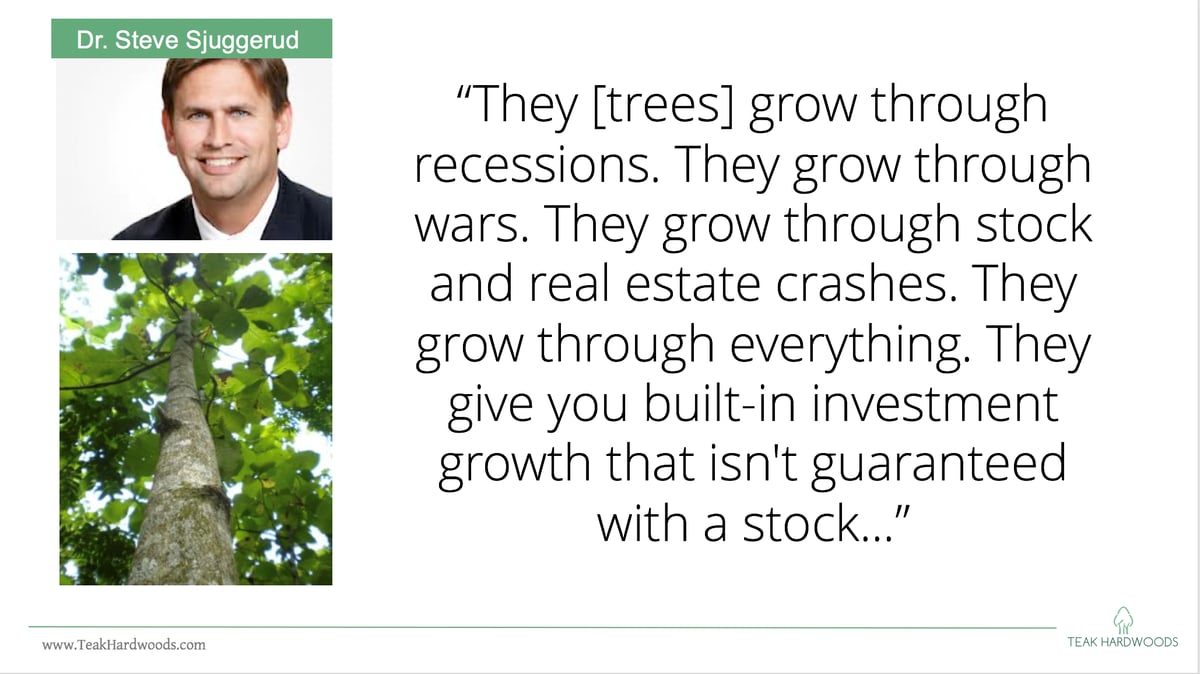

1) Timber is market neutral. It is largely stock market crash and bursting real estate bubble independent. Perhaps Steve Sjuggerud says it best.

Teak Hardwoods Plantation Established 1999

3) The value of Teak timber is derived from two very different factors. The actual physical growth of the tree, and the growth of the price of lumber. They both contribute to the return when the trees are harvested in 25 years.

As Steve says above, trees just grow. And Teak grows well when maintained properly. And professional forestry management companies have centuries of data to create and implement best forestry management practices.

An average Teak tree produces about 350 board feet of lumber, per tree, at age 25. At harvest, 230 trees are cultivated per hectare of land. Today’s board foot prices range from $4.88 wholesale to over $30 retail. 1/10th-hectare parcels are under $10,000. Feel free to run the math.

Now factor in the historical track record of price growth. Just the price of teak, not the accumulating volume of wood growing annually, has climbed over 5.5% per year over the past 100 years. Yes. 100 years. If you have a good calculator, you can run this variable as well.

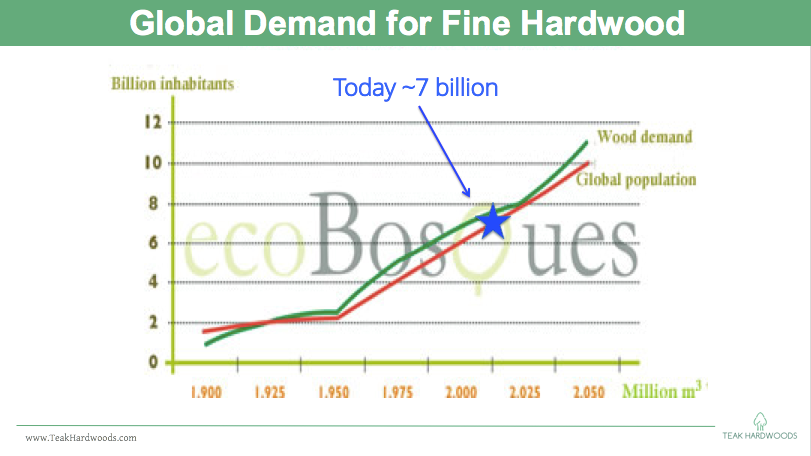

While no one can predict the future, 300+ years of plantation Teak, and 100+ years of price growth are strong indicators of a future that could excellent as well. As you can see in the chart below, timber demand has followed population growth. This is likely to continue.

Plantation parcels begin under $10,000. Owners receive title to the land and own the trees. At the end of the first period and initial harvest, owners will be offered the opportunity to replant alongside all other plantation owners for an efficient economy of scale. Hardwoods, a company with a 20+ year track record already, will be there to manage the process.

And we have a financial incentive to do that. Yes, we make a profit from the initial sale. But our largest share comes from our management fee at harvest. We share in a percent of the profits that the timber owner receives. We have every incentive to deliver the highest value lumber for the timber owner possible. This aligns our interest squarely with those of the plantation parcel owners.

Also, please note: A limited number of 14-year-old teak plantation parcels exist on the recently acquired property. These trees have an 11-year grow out to harvest. For some individuals, ownership of mid-growth Teak may have appeal. This is in addition to the Baby Teak with a full 25 year grow to harvest cycle.

If you are that kind of person who sees beyond today, understands the power in long cycle compounding, and isn’t worried about what your friends will say, download the Teak Whitepaper here.

Get started doing some research and you’ll see for yourself why owning some Teak Timber might be the right long-cycle investment for you.